5 Trending Digital Lending Options (That You Should Try)

The digital lending industry is witnessing major shifts, leading to more convenience, and of course, less paperwork.

And that means it automatically becomes the primary choice for people seeking a loan.

It’s rare for most people to have the time or patience to complete a large stack of paperwork and spend countless hours in the waiting room just to borrow a loan.

So what are the best ways to borrow a loan online?

And how convenient (and safe) is such an option.

Let’s talk about that.

An Overview Of Digital Lending

First things first,

- In 2022, digital lending accounted for 15 percent of India’s total lending market.

- During the financial year 2023, the YoY growth rate of both banks and non-banking financial companies (NBFCs) in India increased to 18% and 17%, respectively.

- The fintech market in India is estimated to grow over two trillion U.S. dollars by 2030.

With 73% of users seeking and standardizing online banking services, it has become distinct and clear that the future of banking is Fintech.

With AI and Big Data, the process of borrowing a loan online is getting easier and reaching the right people.

Even your loan application can get a quick approval – which is ultimately taking the ‘traditional’ aspect of borrowing away from the lending process.

Here’s what’s in trend right now in terms of digital lending options.

The Top 5 Trending Digital Lending Options

1. Loan Against Mutual Funds

One of the most transformative approaches in the digital lending landscape is the ability to secure loans against mutual funds. This option allows you to secure funds, with you pledging your mutual funds as security.

The value of the loan is dependent on the value of your mutual funds and the interest rate you will pay will be based on the amount of loan you’ve borrowed.

The best part about this digital lending option is that you get to keep your investments as it is and have the flexibility to pay the loan amount over time.

So, if you are planning to sell your mutual fund investments, consider pledging them as security and acquire funds from digital lending options. And there’s no need to worry about the paperwork as digitalization has reduced the load of paperwork and automated several processes.

The most prominent benefits of mutual fund loans include:

- Usually lower interest rates as compared to traditional and credit card loans

- Easy borrowing process

- Quick disbursal and loan approval

- Flexible options for repayment

- Still able to earn returns on your investment

Recommended: Loan Against Mutual Funds Guide

2. Buy Now, Pay Later

A trending digital payment option that offers the flexibility to divide payments into equal installments.

It is a widely used option that allows you to schedule your payments according to your feasibility.

Here is a breakdown of BNPL usage amongst different generations:

| Buyers | 2021 | 2023 | 2025 | % Increase |

Gen Z | 36.8% | 46.5% | 47.4% | 10.6% |

Millennial | 30.3% | 39.5% | 40.6% | 10.3% |

Gen X | 17.2% | 26.3% | 30.9% | 13.7% |

Baby Boomers | 6.2% | 12% | 14.8% | 8.6% |

It is no surprise that the Buy-Now-Pay-Later option is the most widely used option worldwide. This option supersedes traditional banking and other types of digital lending methods because it is interest-free.

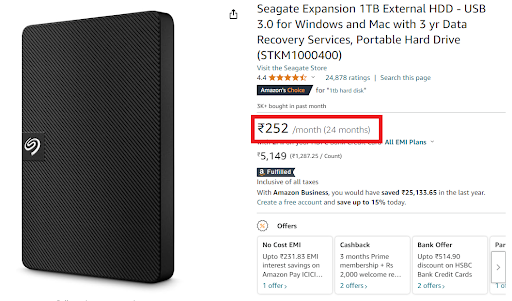

Amazon has a BNPL option, popularly known as a “grace period”, lasting from weeks to months.

You will be surprised to know that this option is quicker and more convenient than getting a credit card because most lenders aren’t interested in learning your credit score history.

3. Peer to Peer Lending

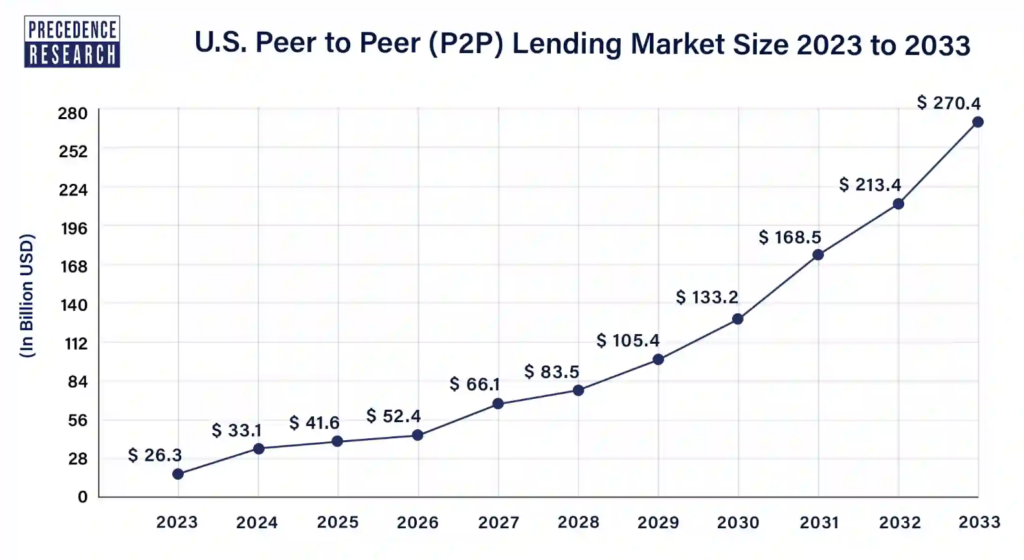

P2P lending market share was $26.3 billion in 2023 and is only expected to grow to $270.4 billion by 2033.

If you’re searching for digital lending options that completely eliminate the role of banks or any other organization, then peer-to-peer lending offers a better option.

This is an alternative digital lending channel that allows you to lend and borrow money directly from one another. You don’t have to seek assistance from traditional banks or similar institutions.

The total cost of peer-to-peer lending platforms is usually lower than most financial institutions.

This gives P2P lending medium an edge as lenders benefit from profitable returns over time whereas borrowers enjoy the advantages of seamless and quick financing along with low interest rates.

4. Blockchain digital lending platforms

The blockchain digital lending scheme functions on the same model as peer-to-peer lending platforms. However, in this case, cryptocurrency is being exchanged.

It is one of the most highly popular and quickly growing digital lending channels — currently holding a market share of $457 billion in the US alone. In blockchain technology, a crypto coin gets exchanged between borrowers and lenders instead of fiat money. Both parties are connected on a platform that has cryptocurrency as its prime mode of exchange.

Now if you’re wondering about interest rates and how it works in this system, you should know that you pay interest in Bitcoin and it can be returned on a daily, weekly, or even monthly basis.

5. Using AI in Finance and Digital Lending

Digital lending platforms are cautious and take drastic measures to ensure secure transactions and data protection.

They’ve implemented Artificial Intelligence and Machine Learning algorithms to navigate credit risks and conduct thorough data analysis for successful and secure digital payments and lending solutions.

In a traditional atmosphere, loans are granted based on the borrower’s financial history.

But with the introduction of digital lending platforms and disruptive technology, you can now make informed decisions.

AI tools, ML algorithms, and Big Data are utilized to explore and investigate a wide range of individual data which includes their digital behavior and social imprint amongst other factors.

For example, AI is being utilized to establish loan eligibility. Some online banks use data from borrowers’ smartphones to analyze their eligibility and assess risk factors. The one thing that gives this process an upper hand is that AI is completely unbiased.

All of this is possible in real-time, so you don’t have to wait for endless hours just to get approval on your loan.

The bottom line

When we speak of digitalization worldwide, we don’t restrict that conversation to shopping online or watching TV shows and listening to music. We apply that notion to everything in life, including digital lending options.

With the emergence of disruptive technologies, we’re witnessing the popularity of various digital lending solutions like peer-to-peer lending platforms and buy-now-pay-later schemes that are all data-driven and secure.

At 50fin, you get your loan approved in 7 minutes!

Our solution is tailored to meet your specific loan needs with just a 10.5% interest rate per annum.

Start by signing up at 50Fin to borrow your loan against mutual funds.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know