7 Ways To Get a Personal Loan Without CIBIL Score

With the introduction of banking and non-banking financial corporations in India, it’s not difficult to borrow a loan anymore.

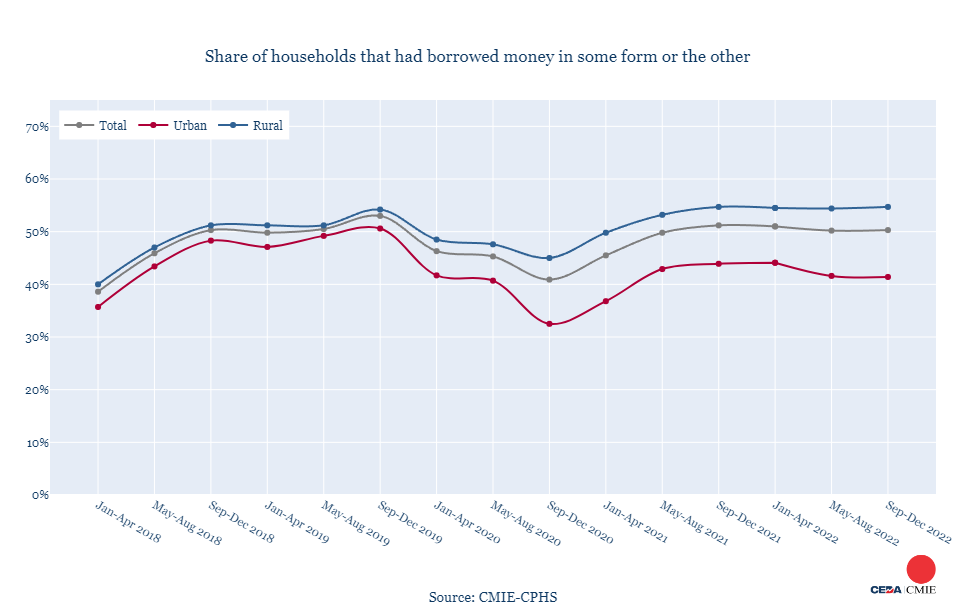

Half of all households (50.3%) in India had borrowed money in some form or the other (as of the Sep-Dec 2022 period).

However, the amount of loan (in most cases) that you can borrow depends on your CIBIL score.

Your CIBIL score is a testament to your creditworthiness. But a borrower without a CIBIL score or with a low score means that it’s difficult for you to either:

- Borrow a loan

- Get good interest rates on the loan

So, are there any alternatives?

Alternatives to loans without CIBIL score

There are still viable pathways to obtain a personal loan.

Here’s a detailed exploration of six expert-recommended methods to secure a personal loan without relying on a CIBIL score.

1. Borrow a Loan Against Mutual Funds

A loan against mutual funds is a modern route to a traditional problem – borrowing a loan.

Even though there are multiple ways of borrowing a loan, mutual fund loans offer what most banks can’t – quick approvals, fast disbursal times, and low interest rates.

All this without the need for a CIBIL score.

Mutual fund loans are a fairly new concept for solving an age-old problem.

If you have a mutual fund portfolio, there’s a good chance you might need cash in your hand from time to time.

Liquidating your portfolio is one option. However, a better alternative is to pledge your mutual fund portfolio and take out a loan against it.

50Fin is one of the best platforms for doing so.

All you have to do is sign up, fill out the e-paperwork, and pledge your mutual fund portfolio.

You’d get an approval within 7 minutes and the money disbursal within 4 working hours.

The convenience and streamlined process that 50Fin offers also comes at just a 10.5% interest rate per annum.

2. Leverage Relationships with Banks

Building a strong relationship with your bank can pave the way for securing a personal loan despite lacking a CIBIL score.

Financial experts suggest opening a savings or a fixed deposit account with a bank and maintaining it actively.

So how can you do that?

- Maintain regular transactions with your bank

- Have a healthy balance in your savings or current account

- Use the services that your bank offers – including fixed deposits and mutual funds

Such activities can build trust, making banks more likely to offer you a loan based on the banking relationship rather than just your credit score.

Engage frequently with bank staff, utilize multiple services, and maintain transparency about your financial status. This personalized engagement helps in building rapport and could work in your favor when applying for a loan.

3. Opt for Collateral-Based Loans

Securing a loan against collateral is another effective strategy.

Assets like real estate, gold, or fixed deposits can be used as collateral to obtain a loan.

According to financial experts, banks are more comfortable providing loans when there is an asset as security.

This not only increases the likelihood of loan approval but also potentially earns you a lower interest rate.

Loans against securities are already on the rise in India, starting with SBI.

Scheme | 1-year MCLR | Spread over 1-Year MCLR | Effective interest rate |

Loan against Shares | 8.95% | 2.50% | 11.45% |

Loan against NSC/ KVP | |||

Loan against RBI Relief Bond | |||

Loan against Insurance Policies of LIC/ Dept. of Post Offices/India Post/SBI Life/ ICICI Prudential/ HDFC Standard | |||

Loan against Sovereign Gold Bond (SGB) | 8.95% | 2.00% | 10.95% |

SBI Interest Rates for Loans Against Securities

Choose an asset that has stable market value and is readily liquidable.

This assures the bank of minimal risk in loan recovery and can facilitate faster processing of your loan.

4. Apply with a Co-applicant or Guarantor

While it is mostly couples who apply for joint loans, the co-applicant can also be a parent, sibling, or child.

This usually happens when one applicant has a poor CIBIL score or lacks the ability to repay loan installments on their own.

What makes joint loans so great is their division of EMI.

The amount of monthly installments can be divided between the two borrowers, easing the financial burden, and adding to their convenience.

It has become quite common to substitute a co-applicant with a guarantor.

Again, this can be anyone – from a close friend to a family member.

All that is required is for them to be a resident of India, be above the age of 18, and have a good enough balance in their account (should you fail to repay).

5. Demonstrate a Stable Income

You have a higher chance of securing a loan if you provide them evidence of regular income.

Loans get instantly approved even without a CIBIL score.

If you are self-employed, you can attach evidence of income through freelance or business.

An income proof builds your case and reflects your creditworthiness.

When you fill out the application form, add the following documents.

- Bank statement

- Pay slip for the last 3 months

- Income tax returns

6. Consider Non-Banking Financial Companies (NBFCs)

Banks put a lot of emphasis on CIBIL scores, reducing your chances of getting your loan approved.

Non-banking financial companies offer a wide range of lending and co-lending agreements without putting any strain on your credit score.

NBFC loans are not only simpler but are also deemed as zero paperwork loans.

In fact, such loans are less expensive, meaning you’d have to pay lower interest rates (starting from 11.50% per annum), making your monthly payments easily manageable.

7. Peer-to-Peer Lending (P2P)

The Indian P2P lending industry has a market value of USD 9.60 billion in 2023 and is expected to grow with a CAGR of 21.66% by 2029.

This digital lending solution helps you secure a loan without a CIBIL score.

Standing in contrast to traditional loans, here you borrow money from a P2P lending platform.

You can repay the loan in flexible monthly installments.

Here’s what you need to provide:

- ID Proof

- Aadhaar or PAN card

- A utility bill (address proof)

- Bank statement

- Income proof (pay slip)

Conclusion

Due to the increased need for financing, Indians have started seeking unconventional lending options when they fail to meet the criteria for the traditional ones.

This allows them to access quick funds even without a CIBIL score.

While you have many options, a loan against mutual funds is definitely the most secure and simpler one.

And at 50Fin, you have zero pre-closure charges.

All you need to do is sign up on our platform and get your loan approved within 7 minutes!

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know