How Can I Get a Small Personal Loan?

Key Insights:

- Whether you are self-employed or a salaried individual, small personal loans are your ultimate lending option for meeting temporary cash shortages.

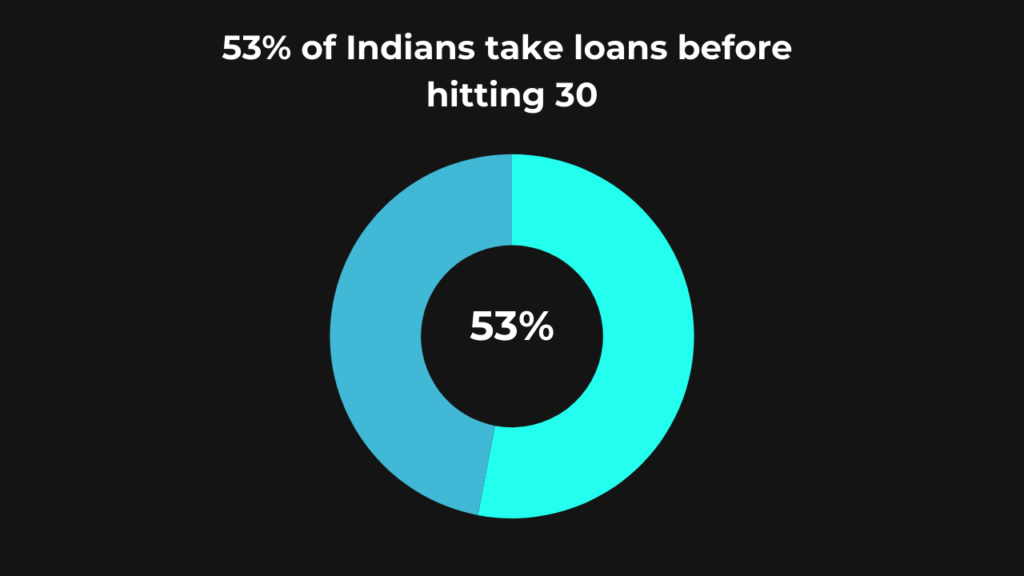

- 22 percent of the personal loan consumers are under the age of 25.

- 53% of Indians take loans before hitting 30.

- A small personal loan is easy to get, requiring minimal paperwork.

- Small personal loans have an interest rate between 10.85% and 16.25% per annum.

- A loan against mutual funds is sometimes a better alternative than small personal loans.

Small personal loans are your ultimate lending option to meet short-term and immediate financial needs.

Whether it is to settle a medical bill or pay for college tuition, you can get small personal loans for a variety of reasons.

So how can you borrow a small personal loan?

Well, we have a detailed guide for you.

What are Small Personal Loans?

A small personal loan is just like any other personal loan – the only difference is the amount of the loan.

It comes with the same set of terms and conditions as most personal loans.

A small personal loan can simply be defined as an unsecured loan that you can avail to meet urgent financial crises – when you’re simply short on cash to cover an expense.

Usually, there are no restrictions on why you need to secure a small loan.

You can get a small loan for home renovations to buy something purposeful or even for travel – if the reason is legitimate, you’re eligible for the loan.

Also, if you’re concerned that only salaried employees are eligible to secure a small personal loan then you’re in for some good news.

Both self-employed individuals and people without professional experience can apply for a small personal loan.

Interestingly, a study suggests that men go for credit card loans while personal loans are popular amongst women.

22 percent of the personal loan consumers were under the age of 25.

Additionally, Gen Z has shown particular interest in personal loans as opposed to Millenial who still prefer credit card loans.

Top Reasons for Personal Loans

While there are various reasons as to why a person opts for a personal loan, the most common ones are listed below:

- For medical emergencies

- To finance a wedding

- Pay for college tuition

- For travel

- For car repair

- To buy home appliance

- To consolidate a debt

Key Features of Small Personal Loans

Before applying for a small personal loan, make sure you understand what you’re asking for.

Being mentally prepared for what’s ahead can help you plan for future finances.

For example, you must know the repayment terms and interest rates mandated by the lending agreement.

Always compare your options before choosing the lender for your small personal loan.

This way, you wouldn’t take on additional debt nor worry incessantly about monthly installment payments.

Let’s explore the most important features of small personal loans.

1. Interest Rates

The range of interest rates on small personal loans varies between 10.85% and 16.25% per annum.

2. Flexible Repayment

The loan repayment is usually flexible. You can repay the loan through monthly installments within 12 to 72 months.

3. Loan Amount

You can get a small personal loan for an amount as low as 50,000 INR going up to 5 lakh.

4. Types of Personal Loans

There are several different types of personal loans.

- Secured Loan

- Buy Now Pay Later

- Salary Advance Loans

- Unsecured Loan

- Debt Consolidation Loan

- Fixed Rate Loans

- Variable Loans

- Joint Loans

5. Quick Disbursal

The best thing about small personal loans is that they are quickly disbursed into your account.

The amount gets disbursed into your bank account within 24 to 48 hours.

6. No Collateral

Small personal loans are popular amongst people who don’t want to have any collateral.

Unlike home loans or gold loans, with personal loans, you don’t have to offer any personal asset as security.

Small Personal Loans Vs. Mutual Fund Loans

There’s another way to secure quick funds without liquidating your assets or taking up loans with high interest rates.

You can opt for a loan against mutual funds.

If you have investments in mutual fund units, you can easily use them as collateral to secure a loan.

This way, you will have access to quick funds while keeping your long-term investments intact.

In fact, 50Fin is a great platform that helps you secure a loan against your mutual fund investments with interest rates as low as 10.5% per annum.

With us, you can get your loan approved in just 7 minutes!

The loan amount depends on the value of your mutual fund units – which greatly depends on the market conditions.

Moreover, you can have the loan amount disbursed into your bank account within 4 business hours.

Preparation for Small Personal Loans

If you want to speed up your loan approval process, make sure you have done your preparation.

Have a checklist of documents. While small personal loans are mostly zero paperwork loans, keep the following documents in one place:

- Your ID proof

- Your Aadhaar Card

- A Utility Bill

- 2 Passport-size Photographs

Also, you must meet the basic eligibility requirements. For instance:

- You should be between the ages of 18 and 65

- You should be an Indian citizen

Loan Against Mutual Funds Is Better Than Small Personal Loans – Our Opinion

Here’s why we believe loans against mutual funds are better than small personal loans.

- They help you meet short-term financial crunches without liquidating your long-term plans.

- The process of securing a loan against mutual funds is extremely fast, efficient, and convenient.

- You can continue having authority over your valuable asset.

- The entire process is digital, unlike traditional loans where you have piles of paperwork and hours in the waiting room.

The Bottom Line

Small personal loans are the most common lending option for meeting quick cash shortages.

Whether there’s a medical bill that you have to settle or you want to urgently travel somewhere, a small personal loan can be your ticket to financial stress relief.

While small personal loans are easy lending options, loans against mutual funds offer more convenience and benefits.

Confirm your eligibility and learn more by signing up on our platform.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know