Are Personal Loans With Mutual Funds Better Than Credit Cards?

Key Insights

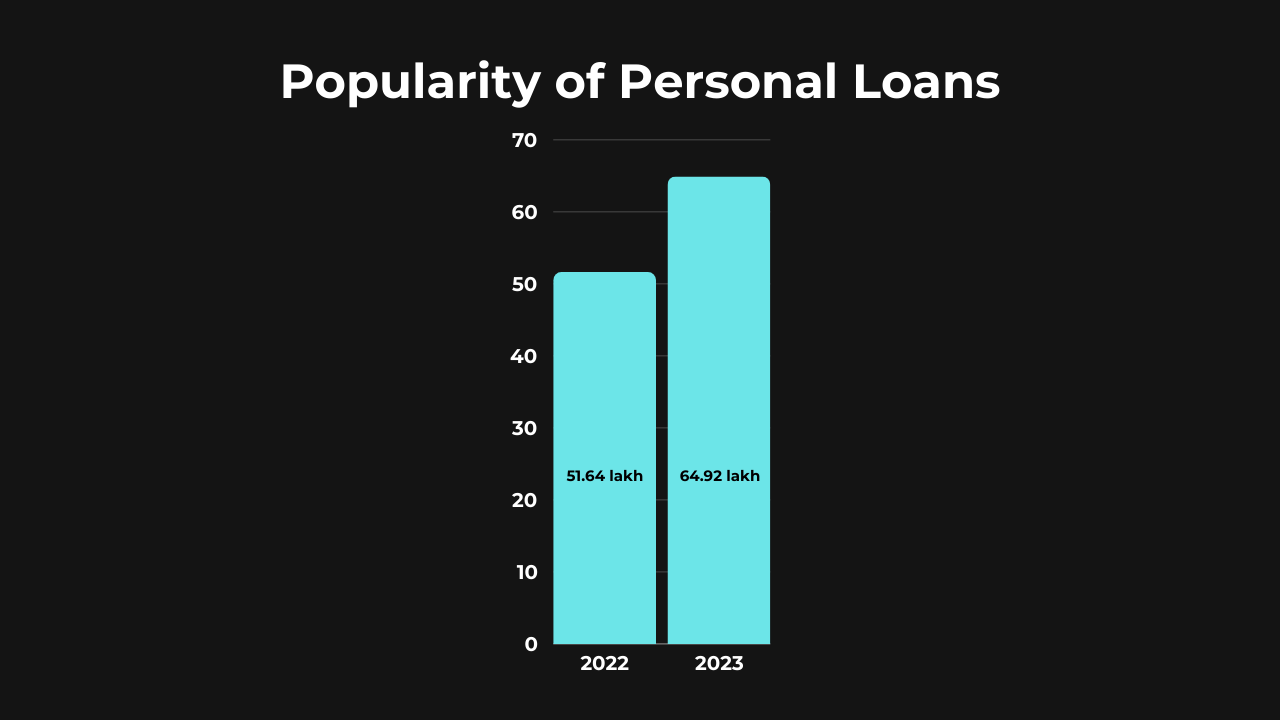

- The popularity of personal loans has increased by 25.73% as per the latest search trends in India.

- Loans against credit cards are often categorized as unsecured loans as they come with higher and variable interest rates.

- A loan against mutual fund units is often a more secure option as not only it allow you to keep ownership over your investments, but it quickly meets short-term financial needs.

- Loans against mutual funds have lower interest rates with flexible repayment options.

In 2022, the search volume for personal loans was 51.64 lakh in India.

By 2023, it was 64.92 lakh, indicating a 25.73% growth.

This comprehensive analysis suggests the rising popularity and increasing demand for personal loans in India.

It also highlights the rapid change in consumer behavior.

Whether it is to meet an unexpected medical emergency or to finance your wedding, a personal loan is the first thought that comes to mind whenever you’re short on cash.

But should you take a personal loan against mutual funds or a credit card?

Let’s talk about that in detail.

Understanding Credit Card Loans

A loan against a credit card is an unsecured loan with little to no paperwork.

It’s an unsecured loan as there’s no collateral.

You can opt for a credit card loan to pay tuition fees, a medical bill, or even to fund a vacation.

Most financial institutions offer a credit card loan up to 20 lakh but it does come with a high interest rate.

While the repayment tenure varies, you usually get 60 months to settle the loan.

While the eligibility varies from bank to bank, getting a loan approved isn’t a problem with a good credit score.

What Exactly Are Loans Against Mutual Funds?

Loans against mutual funds are an unconventional route for securing quick funds.

Unlike traditional loans, this method allows you to borrow funds without losing ownership over your mutual fund units.

Here’s what really happens when you opt for a loan against your mutual funds.

You use your mutual fund units as collateral.

This way, you continue your long-term investment plan while meeting short-term cash-strapped situations.

The amount of money you can borrow depends on the total worth of your mutual fund units.

50Fin can help you get a loan against your mutual funds in a few simple steps.

Typically, your loan gets approved within 7 minutes and the amount is disbursed into your bank account in 4 business hours.

The interest rates are super affordable and as low as 10.5% per annum.

Offering your mutual fund units as collateral reduces the level of risk for the lender, making it a secured loan – for both the lender and the borrower.

Eligibility Criteria for LAMF

- You should be a citizen of India

- You must be between the age range of 18 and 65

- You should have a minimum portfolio value of Rs 50,000 (in the case of 50Fin)

And what gives 50Fin an edge is that it doesn’t require any minimum credit score or income proof.

This increases the overall accessibility of loans against mutual funds.

Comparing Mutual Fund Loans with Credit Card Loans

While you can easily get loans against credit cards, they do come with higher interest rates.

On the other hand, a loan against mutual funds has several advantages, like lower interest rates and continuous earnings from profit returns.

Let’s make an extensive comparison to help you make the best decision.

- When you opt for a loan against your credit card, the banks typically block the withdrawal limit until the repayment is finalized. But if you choose a loan against mutual funds, not only do you continue to earn profit from your investment, but you also get access to funds.

- Credit card loans are unsecured loans whereas loans against mutual funds are more secure digital lending options. This is important as secured loans have lower interest rates than unsecured loans, making mutual fund loans a more economical option and an attractive choice.

- While both loans against credit cards and mutual funds require minimal paperwork, loans against mutual funds are strategically better.

Also called zero paperwork loans, you can get a loan against your mutual funds within minutes while sitting at home and eating lunch.

This is possible because the entire process is digital.

3 Reasons Why Loan Against Mutual Funds is Better

Various reasons make mutual fund loans a better alternative than credit cards. But to help you decide faster, we’ve narrowed it down to the following three reasons.

1. Continue Earning Profit

A loan against mutual funds allows you to continue gaining profit from your investments.

This option is not available with credit card loans, considering most of the time, your account puts a limit on the amount withdrawn.

Imagine having an option to earn returns while also getting immediate access to funds.

2. Meet Short-Term Meets Without Abandoning Long-term Financial Plans

A loan against a mutual fund can help you meet short-term cash shortages without abandoning your long-term financial plans.

This makes it the ultimate option as you get to keep ownership of your financial investment without struggling due to temporary cash-strapped situations.

3. Flexible Repayment Options

When you opt for a loan against a credit card, the repayment can be difficult as the interest rates are high and dependent on the amount you’ve utilized.

Also, the tenure tends to be shorter, usually lasting as long as 60 months.

But with loans against mutual funds, you’ve got flexibility in the name of lower interest rates and convenient EMIs.

Conclusion

A personal loan against mutual funds is a better alternative than a loan against a credit card.

Having lower and more manageable interest rates isn’t the only parameter that gives mutual fund loans an advantage.

It is actually the combination of features of LAMF that gives it a more favorable stance, like flexible repayment and continued profit earning.

With 50Fin, the possibility of getting a personal loan against mutual funds becomes even faster – 7 minutes to be precise!

Start by signing up at 50Fin today.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know