Best Mutual Fund Options For Beginners: A Quick Guide

No matter what stage of your investment journey you’re in, mutual funds always seem to be a more cordial option.

The option of diversification, steady returns, and timely investments is almost a dream come true for everybody trying to enter the world of investments.

However, in case you’re just getting started, it’s important to understand the ins and outs of mutual funds and what kinds of investments would be right for you.

And that’s what this blog post is about.

Let’s get started.

Benefits of Investing in Mutual Funds

Mutual funds don’t need an explanation.

Yet we advise you to still be aware before you invest anywhere.

A mutual fund acts as an investment vehicle where investors pool money to purchase a diversified portfolio of securities.

This includes stocks, bonds, or other assets.

Professional fund managers manage these funds, aiming to generate returns for investors.

Every type of investment has its own unique set of advantages.

Here are a few key benefits of investing in mutual funds:

1. A vehicle to borrow loans

An important benefit of having a mutual fund portfolio is that you can use it to borrow a loan against it.

Yup, a loan against your mutual funds.

That’s what we at 50Fin offer too.

You can pledge your mutual funds portfolio to borrow a loan against it and unlock funds instantly.

Moreover, this allows you to get access to cash instantly without having to liquidate your portfolio.

2. Steady Returns

Mutual fund investments are usually a vehicle to keep earning steady returns in the long run.

Depending on the type of investment, you can use your mutual funds to lay down long-term and short-term goals.

Most importantly, this also allows you to plan for events like buying a car, borrowing a home loan with mutual funds, or even retirement.

3. Convenience

Investing in mutual funds is equally straightforward and convenient.

Investors can also quickly purchase shares through financial advisors, brokers, or online platforms.

The provision of features like systematic investment plans (SIPs) and automatic reinvestment of dividends allows you to make timely payments toward your portfolio.

The value keeps on accumulating to help you put together a very solidified portfolio.

4. Regulatory Oversight

Unlike a few digital financing options, mutual funds are regulated by government agencies.

These agencies include the Securities and Exchange Board of India (SEBI).

This regulatory oversight ensures that mutual funds operate within legal guidelines, providing an added layer of protection for investors.

Mutual funds are required to provide regular updates on their performance, holdings, and expenses.

This transparency also allows investors to track how their investments are performing and understand the costs associated with their investments.

Types of Mutual Funds

1. Equity Funds: Equity mutual funds invest primarily in stocks and aim for high growth. They are suitable for investors with a higher risk appetite and a longer investment horizon. You can also borrow a loan on your equity mutual funds.

Recommended: Types of Mutual Funds

2. Debt Funds: These invest in fixed-income securities like bonds and treasury bills. They are generally considered lower risk than equity funds and are suitable for conservative investors seeking stable returns.

3. Hybrid Funds: These funds invest in a mix of equities and debt, balancing risk and reward. They are ideal for investors looking for moderate risk and balanced returns.

4. Index Funds: These funds aim to replicate the performance of a specific index, such as the Nifty 50 or Sensex. They are passively managed and usually have lower fees.

Best Mutual Funds for Beginners in India

Here are some mutual funds that are considered good choices for beginners in India:

1. Axis Bluechip Fund

Type: Equity Fund

Features: Axis Bluechip Fund invests in large-cap companies with a track record of stability and growth. It’s a relatively safer equity fund for beginners due to its focus on established companies.

Performance: Consistently among the top performers in the large-cap category.

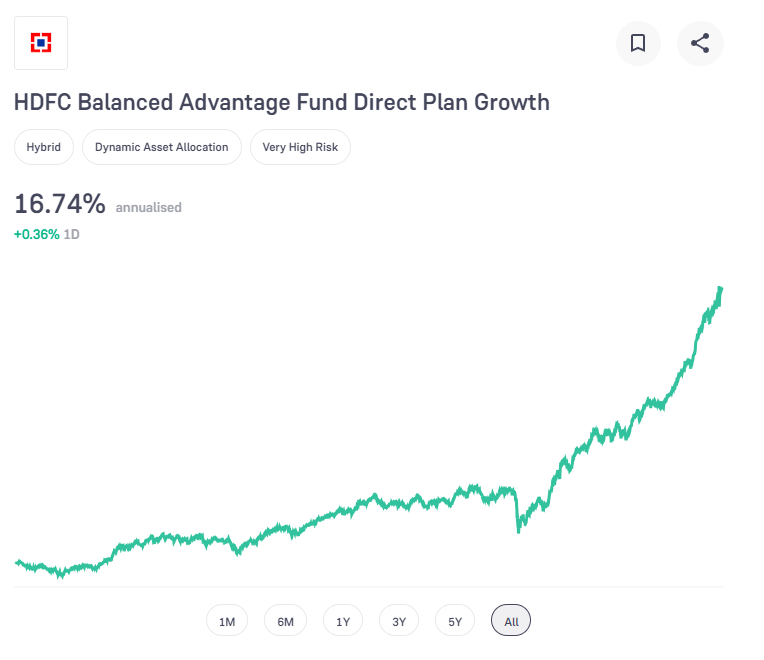

2. HDFC Balanced Advantage Fund

Type: Hybrid Fund

Features: This fund balances risk by investing in both equities and debt. It adjusts the equity-debt allocation dynamically based on market conditions, making it suitable for beginners who want balanced exposure.

Performance: Known for delivering steady returns with moderate risk.

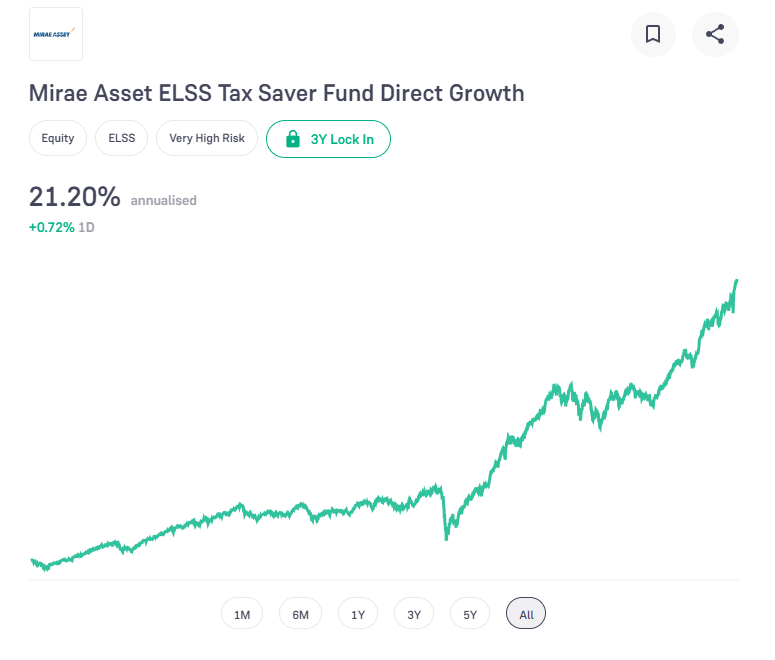

3. Mirae Asset Tax Saver Fund

Type: ELSS Fund

Features: Offers tax benefits under Section 80C. It invests in a diversified portfolio of stocks and has a three-year lock-in period, encouraging long-term investing.

Performance: One of the top-performing ELSS funds over the past few years.

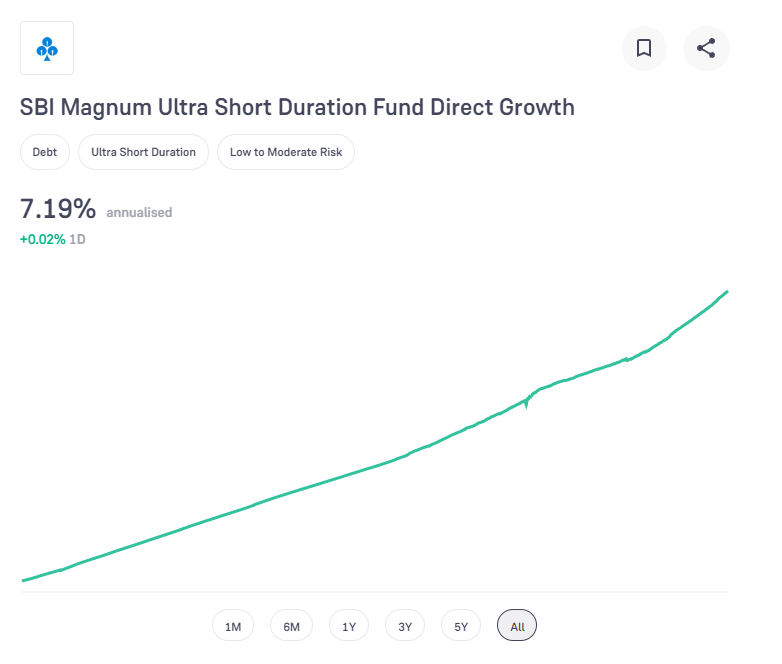

4. SBI Magnum Ultra Short Duration Fund

Type: Debt Fund

Features: Ideal for conservative investors looking for short-term investment options. It invests in short-term debt securities, providing stability and moderate returns.

Performance: Consistent performance with low risk.

Conclusion

The Indian markets are a great place to start your mutual fund investment journey.

By understanding the different types of mutual funds, considering your investment goals and risk tolerance, and choosing the right funds, you can build a diversified portfolio that meets your needs.

Moreover, with the ability to borrow loans against mutual funds, it’s always a great option to start investing in mutual funds.

And the best place to borrow your mutual fund loan is at 50Fin.

FAQs

Can I start investing in mutual funds with a small amount of money?

Absolutely! Many mutual funds have low minimum investment requirements, making them accessible to investors with small amounts of money.

Are there any risks associated with investing in mutual funds?

Like all investments, mutual funds come with risks. However, diversification and professional management can help mitigate these risks.

How do I choose between actively managed and passively managed funds?

Actively managed funds are managed by professionals who actively buy and sell securities to outperform the market. Passively managed funds, such as index funds, aim to replicate the market’s performance. Your choice depends on your investment strategy and risk tolerance.

How do I choose the right mutual fund for me?

To choose the right mutual fund, assess your risk tolerance, evaluate performance, consider expenses, and align the fund with your financial goals.

Can I lose money investing in mutual funds?

Yes, there is a possibility of losing money in any investment, including mutual funds. However, a well-diversified portfolio and a long-term investment horizon can help manage this risk.

Can I invest in mutual funds online?

Yes, most mutual funds allow online investments, making it convenient for investors to start their investment journey from the comfort of their homes.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know