Can A Student Borrow A Personal Loan?

Key Insights:

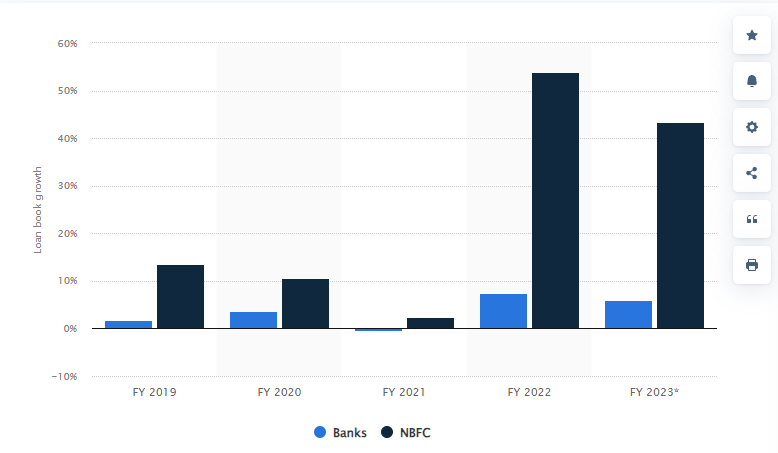

- In the first half of 2023, the non-banking financial companies witnessed a growth of over 43 percent in their education loan book growth.

- While personal loans are common, taking a loan against your mutual funds may be a better alternative.

- To secure a personal loan, consider its interest rates, processing fees, and penalty charges should you default.

- Gather all necessary documents and evaluate all lending options before opting for a personal loan.

Higher education has become a luxury as its cost keeps increasing with time.

Whether you need to pay your tuition or need money to buy books and other educational supplies, a personal loan is what you need.

In fact, it has become a common practice to seek external funding, like scholarships and personal loans, to meet educational expenses.

In the first half of 2023, the non-banking financial companies witnessed a growth of over 43 percent in their education loan book growth.

Students often wonder if they can apply for a personal loan by themselves.

So, let’s explore how students can take a personal loan.

Understanding Personal Loans

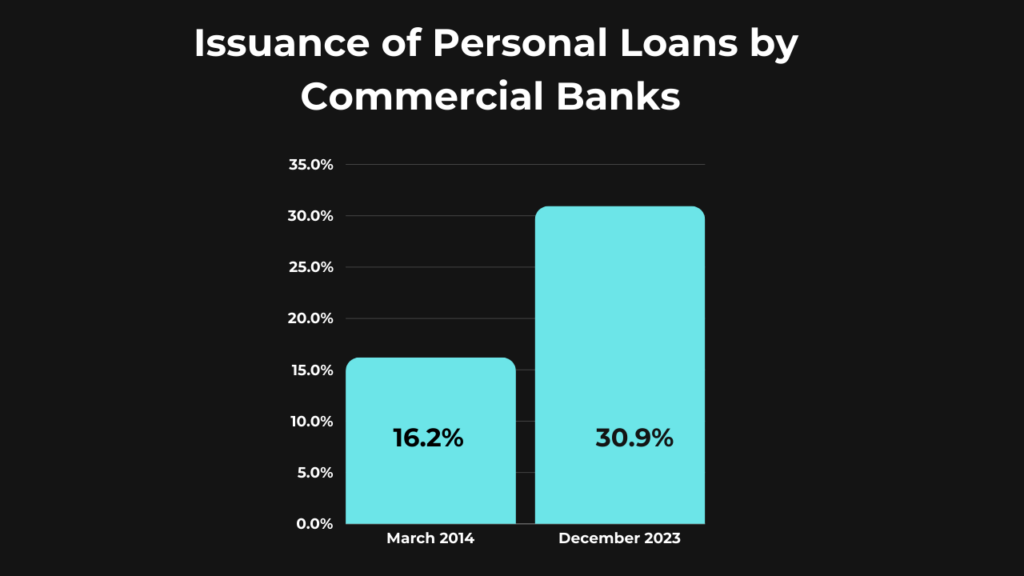

A personal loan is the most convenient way to meet short-term financial crises.

Ideal for individuals with steady incomes, personal loans are becoming increasingly popular as lending options amongst students to finance their higher education.

Just like any other loan, you can repay this loan in flexible installments with interest, which may increase with time should you go for an unsecured loan.

You can get a personal loan from both financial institutes and non-banking financial institutions.

How Can Students Get Personal Loans?

Most financial institutions don’t offer personal loans to students.

Their reasoning is fair. Students don’t have a proper source of income, making the financier question their ability to repay the loan.

There are two easy ways to secure a personal loan:

- Sign a co-application

- Offer a collateral

Here’s what you can do.

You can either apply for a joint loan and have your parents or anybody else (with a good credit score) sign the loan application with you.

Or you can use your mutual fund loans as collateral, assuring the financier that you will repay the loan.

5 Features of Personal Loans

Before you opt for a personal loan, you must understand the terms and conditions to better plan and schedule its repayment.

For example, you should know how much loan you can secure, if there’s any upfront fee, and the interest rate applicable to your total loan amount.

1. Loan Amount

While there are different amounts of personal loans in India, students can avail themselves of up to 40 lakh INR to fund their higher education.

This amount may vary from lender to lender, depending on your financial situation and history.

2. Repayment

It is important to select a repayment plan that is flexible enough to adjust your financial situation – especially if you’re considering your educational and professional goals.

Most of the time, the repayment tenure is between 1 and 5 years.

Thus, make sure you establish the monthly installment plan and divide it in a convenient way.

3. Collateral

Personal loans are traditional loans, so most of the time, there’s no collateral.

This is true, especially when you take a loan for educational purposes.

While it may not be the most secure route, it is still popular and convenient for you.

4. Interest Rates

The irony is that taking a personal loan itself can be slightly expensive.

You have interest rates, processing fees, and penalties to pay should you fail to repay the loan on time.

Most financial institutes offer personal loans with interest rates between 9.27% and 24%.

5. Upfront Fees

In some cases, you might have to pay an upfront fee, also known as a processing fee.

Although, it depends on the lender and their terms and conditions.

Eligibility Criteria for Student Personal Loans

If a student wants to borrow a personal loan, they have to meet certain criteria to secure it. Let’s take a look at it.

- You should be between 18 and 65 years of age.

- You should ideally have one year of work experience.

- Either your or your co-applicant’s credit score should be above 750.

- You must have salary slips and a statement of proof of income

- You should be a resident of India with all the necessary documents

3 Actionable Tips Before Opting for Personal Loans

Securing a personal loan shouldn’t be impossible should you follow a well-thought-out plan. Let’s take a look at the three most important, actionable tips.

1. Gather All Documents

While personal loans require minimal paperwork, there are a few documents that you must compile and provide along with your loan application.

The purpose of gathering all your documents beforehand is to make the application process seamless and hassle-free.

Here’s your checklist:

- ID proof (PAN, Aadhar card, Passport, driving license)

- If employed, include the salary slips

- 3-month bank statements

- Two passport-size photographs

- If your co-signer is self-employed, add their business registration details (business certificate and bank statements)

2. Evaluate All Options

A personal loan may be convenient but you must consider all your options first. The idea is to secure a fund without breaking the bank.

Also, you must choose a lender that meets your requirements and isn’t too stiff.

3. Determine the Ability to Repay Loan

Can you even repay the loan? This is an important question to ask before applying for a personal loan.

If you default on your loan, you can ruin your credit score and chances of securing any other loan in the future.

So be careful before moving ahead with this lending option.

Loan Against Mutual Funds – A Better Alternative

Sometimes we opt for a personal loan because we lack financial guidance.

There are better alternatives for personal loans – options that are much more secure and slightly unconventional.

Having investments in mutual funds can open up several financial prospects for you.

Not only are mutual funds great long-term investments, but they are also useful in meeting temporary financial needs.

You can always use your mutual fund units as collateral to secure a loan.

50Fin takes it a step further by making the process entirely digital.

You can get your loan approved in 7 minutes and have the amount disbursed into your bank account within 4 business hours.

And the best part? The interest rates are as low as 10.5%!

Loans against mutual funds are far better and more convenient than a personal loan – letting you meet short-term financial goals without terminating your long-term plans.

The Bottom Line

While the options are limited, students can borrow a personal loan in India.

Personal loans are effective ways of meeting short-term financial needs, like financing your education.

Higher education is expensive and comes with several cost considerations, like tuition fees, the cost of books, and other miscellaneous expenses.

50Fin can help you secure a personal loan against your mutual fund investments.

The loan can be approved within minutes with the entire process taking place online.

All you have to do is sign up on our platform and pledge your mutual funds to borrow a loan.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know