Digital Lending Vs. Traditional Lending - What to Choose?

You have a requirement for a loan and you’ve a few ways of borrowing it.

You can either approach a bank, ask your friend or family member, or choose a more flexible option – perhaps digital lending.

India is evolving quickly, and so are our finance and credit options.

With the rapid development of online financial services, digital lending has created a new way of lending solutions that operates entirely online and won’t require you to visit the branch regularly.

But how reliable are these digital lending processes over traditional lending?

And should you even entertain such an option in the first place?

Let’s find out!

Why is digital lending getting popular in India?

India precisely is home to 1.4 Billion people.

This means that even though there’s an abundance of credit options and banks, there’s also a possibility that your loan application will involve sitting in lines, going from office to office, and filling out a lot of paperwork.

Digital lending is precisely the opposite.

By pursuing a digital lending option like loans against mutual funds, you’re already eliminating the need to sit in lines, fill out physical paperwork, and wait for weeks to find the status of your loan application.

Digital lending vs traditional lending

Traditional Lending | Digital Lending |

Usually involves waiting for a long time to discover the status of your loan application. | It is comparatively faster and most of the individuals receive their funds in the same day. |

It is a time-consuming process as you need to go to the branch to apply for a loan. | The loan process is extremely easy as you can fill out the form online from anywhere. |

Usually includes a higher interest rate depending on the bank and your credit score. | It has low interest rates depending on the type of loan you want to borrow. |

Key Differences between Digital Lending and Traditional Lending

1. Location

One of the big problems that traditional lending faces is the distance.

The distance means that every single discrepancy and inquiry about your loan applications needs a visit to the bank.

With the introduction of digital lending, this problem is immediately solved.

Borrowers will be able to initiate the loan application and track everything on their own.

This change toward digital solutions not only saves time but also gives the chance to avail the services from a rural or remote area.

2. Flexibility

Traditionally, borrowing a loan from the bank or transferring the money requires an in-person visit to the bank.

Moreover, the fixed or limited operating hours can cause trouble as it can very well clash with the working hours of many people.

With the use of digital lending, you can easily manage and track your loan application from your phone.

Additionally, you will be able to use the financial services at almost any time without being physically available.

This move not only helps in mitigating the regular visits to bank branches, but it also enables the borrowers to manage their finances on their terms.

3. Credit Requirements

Most banks, if not all, require you to adhere to a healthy credit score.

If you don’t have a credit history, chances are that getting a loan at a favorable interest could be more difficult.

And even if you have a credit score, banks are usually strict with their credit score requirements and rely on this score heavily.

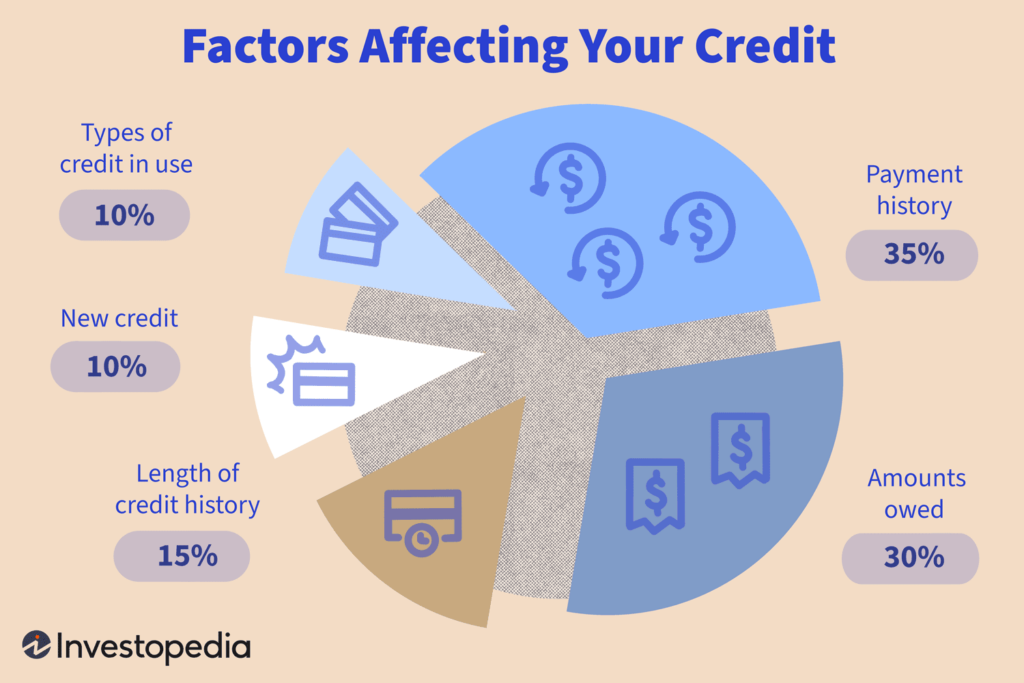

Here’s an analysis of how your credit score is formed.

On the other hand, digital loans usually don’t rely on credit scores to evaluate your application.

Most use alternative data, such as your education, employment history, or even social media activity, allowing more flexibility for those with less conventional credit profiles.

4. The Costs

The operational costs of letting you borrow a loan are usually higher with banks.

The cost of funds for banks is usually higher in banks because of transactional and interest rates.

However, digital loans are different.

Digital loans often have lower fees and competitive rates.

Even at 50Fin, the mutual fund loans that you borrow could be availed at a 10.5% p.a. interest rate.

Digital loans vs traditional loans: What should you choose?

Choose traditional lending if:

- You prefer face-to-face interaction and personalized service.

- You have an established relationship with a bank or credit union.

- You’re comfortable with a longer application and approval process.

- You have a well-established credit score.

Choose digital lending if:

- You need quick access to funds.

- You’re comfortable using technology and online services.

- You have a non-traditional credit profile or are looking for alternative ways to prove creditworthiness.

- You’re seeking competitive rates and lower fees.

So which is the best option?

Digital and traditional forms of borrowing a loan have their own set of pros and cons.

Even though one may seem better than the other, most times, the final option boils down to how soon and how much of a loan amount you need.

Digital lending, however, is quickly catching up in terms of convenience for customers.

A simplified process and a minimized use of paperwork are what’s making this type of loan popular.

At 50fin, we offer digital lending in the form of mutual fund loans.

We offer 7-minute loan approvals with a 10.5% interest rate to fulfill your immediate loan requirements.

Sign up now to start borrowing a loan against your mutual fund portfolio.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know