Is an online loan against mutual funds worth it?

The need to fulfill necessities is indefinite.

And loans make them easier.

Indian citizens are taking more loans with every growing day.

As per a Tier 1 city survey, ~71% of respondents were willing to borrow between ₹30,000 to ₹2 lacs for home renovations and constructions, business investments, and other purposes.

No matter what your purpose for borrowing a loan may be, one of the most convenient options is to look for simpler solutions… like loans on mutual funds.

But are mutual fund loans even worth it?

And if they are, are they meant for you?

Let’s find out.

What are online loans against mutual funds?

You have already worked hard to build your mutual fund portfolio.

You select funds, then you select schemes, pay your monthly SIPs, and check it every now and then.

Staying committed to your investments against market swings isn’t easy.

What’s an even more difficult decision to make is to liquidate your portfolio when you’re in need for emergency funds.

But loans against mutual funds offer an alternative route.

Online mutual fund loans can provide you with the necessary liquidity for your goals. You can get this liquidity without having to liquidate your portfolio.

You can just have your mutual fund units as collateral and get an instant loan to fulfill your goals.

A regular loan rarely has such an advantage.

Benefits of loan against mutual funds

Mutual fund loans are an easy option that complements your investment goals.

When you combine investments with borrowing against investments, you can get a financial goal booster.

Let’s talk about the benefits of loans against mutual funds.

1. Keep your investments intact

A loan against mutual funds is a booster of your goals.

And guess what? You do not have to liquidate your mutual fund units yet. Just unlock your mutual fund portfolio power without having to redeem it.

This is because all you need to do is pledge your mutual fund units to borrow a loan.

This pledging of mutual fund units as collateral would enable you to borrow more from your owned portfolio.

2. Quick approval and disbursement hours

Traditional loans involve tedious processes of applications and approvals.

But unlike traditional loans, mutual fund loans are digital, which also makes them quick to apply for.

Most importantly, the disbursal time is also just a few hours.

With 50Fin precisely, your funds could be disbursed in just 4 working hours.

Your loan, being collateral-based, is quicker and hassle-free than any traditional loan process.

3. No pause to compounding

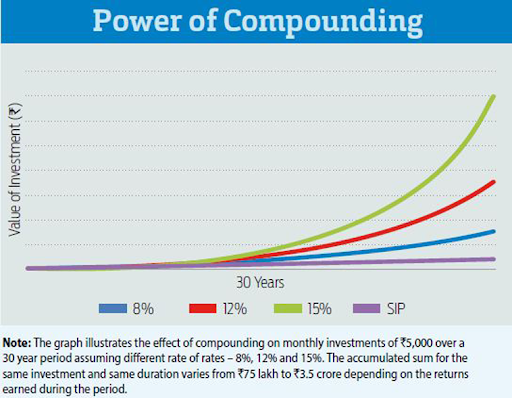

Mutual funds are beneficial in the long run with a process called compounding.

A loan against mutual funds can help you avoid a pause on your portfolio compounding.

This means you can stay invested for as long as you want without having to compromise on your financial goals.

Your long-term wealth is being created with financial goals being fulfilled on the way through mutual fund portfolio pledging.

How to borrow a loan against mutual funds?

Coming to the most important part — the steps to take a loan against mutual funds.

Well, we can ensure it isn’t as tough as your conventional loans.

These steps would be different for different lenders.

However, there is still a common pathway to the process:

- Eligibility and loan amount evaluation: There are eligibility criteria to assess your permissible loan limits. These limits are based on your loan amount and the value of your mutual fund units.

- Finalizing a Lending Institution: At just a 10.5% p.a. Interest rate and loan approval in 4 working hours, 50Fin is one of the best lenders across India for you to borrow your mutual funds loans.

- Application Submission: Because of pledging your mutual fund portfolio, the entire application process is digital and requires no physical paperwork. All you need to do is to pledge the required mutual fund units by providing the necessary authorization.

- Loan Disbursement: Once your documents are successfully verified, the loan is disbursed directly to your bank account. Loan disbursement usually takes 4 working hours with 50Fin.

But is it worth it?

Your investments ideally should be able to cover your short-term as well as long-term goals.

However, most times, for you to get access to instant funds, you’re required to liquidate your portfolio and take out the money.

While that’s a fair option, it ends the years’ worth of hard work and market fluctuations that your portfolio has witnessed.

But a mutual fund loan is different – since it prevents you from liquidating your portfolio while also providing you with the funds that you need.

And the best part is that you get to have both your investments and your goals at your fingertips with 50Fin.

With a completely digital process, approval in 7 minutes, zero documentation, no CIBIL score requirement, and approval in 4 working hours, you can easily borrow a loan against mutual funds with 50Fin.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know