Unlocking the Potential: A Comprehensive Guide to Loans Against Mutual Funds in India

In India’s evolving financial landscape, investors are constantly seeking ways to leverage their assets for liquidity without disrupting long-term financial goals. One such strategy gaining popularity is availing a loan against mutual funds (LAMF). This facility allows investors to pledge their mutual fund units as collateral to secure funds while their investments continue to generate returns.

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

What is a Loan Against Mutual Funds?

A loans against mutual funds is a type of secured loan where investors use their mutual fund holdings as collateral to borrow money from banks, non-banking financial companies (NBFCs), or digital lending platforms. Instead of selling mutual fund investments, investors can access liquidity while allowing their investments to continue compounding over time.

How Does It Work?

- The borrower applies for a loan against their mutual funds.

- The lender marks a lien on the pledged units, meaning they cannot be redeemed or sold until the loan is repaid.

- The loan amount sanctioned is typically a percentage of the Net Asset Value (NAV) of the pledged mutual funds.

- The borrower continues to own the mutual fund units and earns returns from them.

- Once the loan is repaid, the lien is lifted, and the mutual fund units become accessible for redemption.

Benefits of Taking a Loan Against Mutual Funds

One of the best ways to borrow money is by getting a loan against your mutual funds.

1. Liquidity Without Selling Investments

Investors can obtain liquidity without redeeming mutual fund units, allowing them to retain the benefits of potential long-term capital appreciation.

2. Lower Interest Rates Compared to Personal Loans

Since a loan against mutual funds is secured, lenders charge lower interest rates compared to unsecured personal loans or credit card loans. Interest rates start from 10.25% per annum, depending on the lender and fund type.

3. No Impact on Credit Score

Unlike personal loans or credit card debt, a loan against mutual funds does not require a high CIBIL score. This makes it accessible even to those with limited credit history.

4. Quick Processing and Minimal Documentation

Many lenders, including 50Fin, offer a completely digital process, with loan approval within hours and fund disbursement within 24 hours (HDFC Bank).

5. Flexible Loan Repayment Options

Borrowers can choose repayment schedules that suit their financial situation. Many lenders offer zero prepayment penalties, allowing borrowers to close the loan early without additional costs.

Eligibility Criteria for Loans Against Mutual Funds

The eligibility criteria may vary depending on the lender, but the following are common requirements:

- Age Requirement: Generally, borrowers must be between 18 and 75 years old.

- Mutual Fund Holdings: Borrowers should have equity or debt mutual funds in their name.

- Ownership Type: The applicant must be the primary unit holder of the mutual fund.

- Minimum Portfolio Value: Some lenders require a minimum portfolio value of INR 50,000.

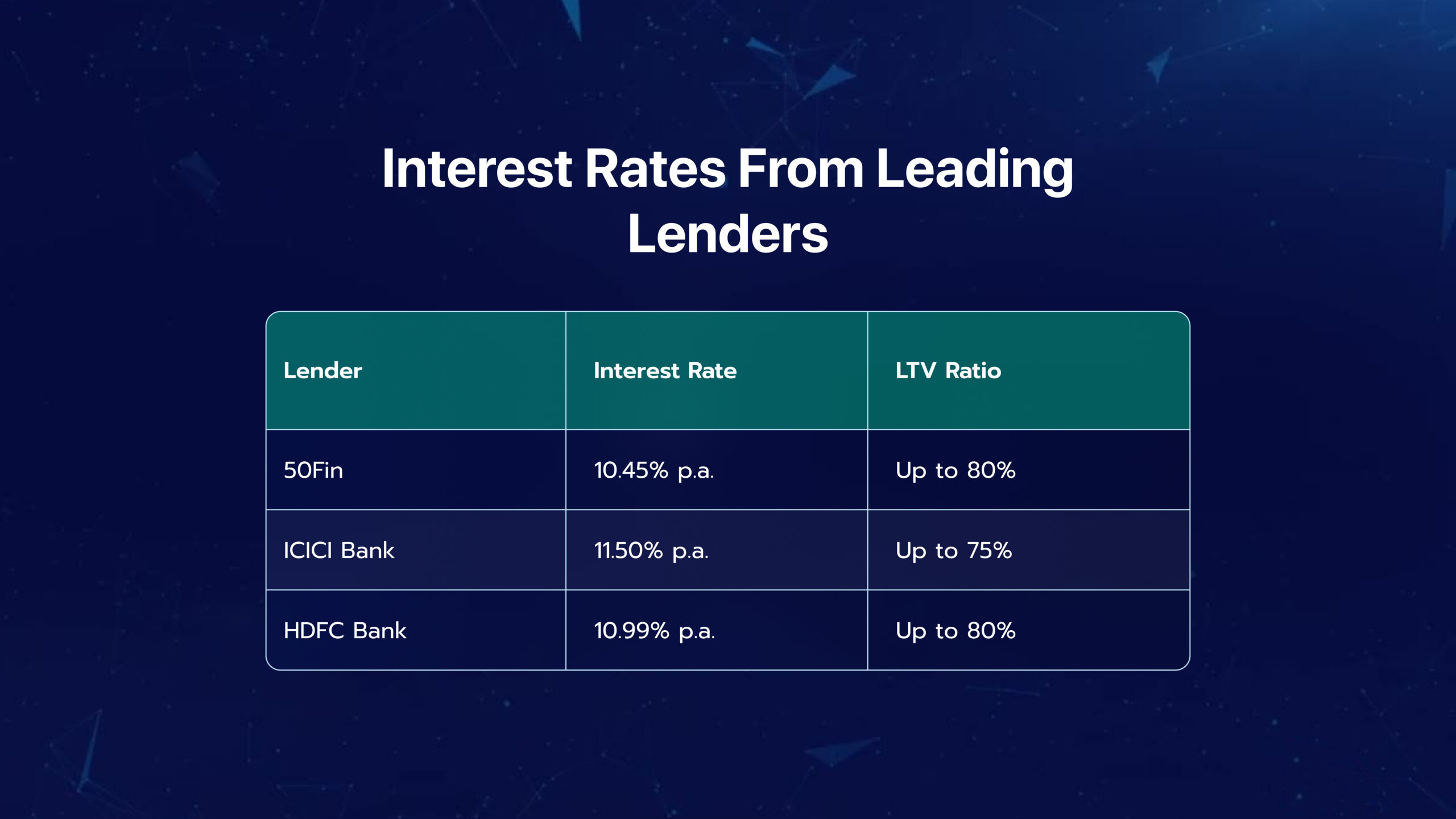

Loan-to-Value (LTV) Ratio and Interest Rates

The Loan-to-Value (LTV) ratio determines the amount of loan one can get against mutual fund holdings:

- Equity Mutual Funds: Up to 50% of the NAV

- Debt Mutual Funds: Up to 80% of the NAV

Step-by-Step Application Process

Visit the 50Fin Website or download the 50Fin mobile app to apply for a loan in minutes.

Fetch Portfolio

Connect your mutual fund account to fetch your portfolio details instantly.KYC Verification

Complete a quick KYC verification to proceed with your loan application.Pledge Mutual Funds

Select the mutual fund units to be pledged, and the lender marks a lien on them.e-Agreement Signing

Digitally sign the loan agreement to confirm the terms and conditions.e-Mandate Setup & Loan Disbursal

Set up an e-Mandate for seamless repayments, and receive funds in your account within hours.

With 50Fin, get instant approvals and loan amounts starting from ₹25,000.

Frequently Asked Questions (FAQs)

1. How is a loan against mutual funds different from a personal loan?

A loans against mutual funds is secured, meaning it has lower interest rates (10-11% p.a.) compared to unsecured personal loans, which typically have 14-18% p.a. interest rates.

2. Can I still earn dividends on my pledged mutual funds?

Yes. Even when mutual funds are pledged, you continue receiving dividends and market returns.

3. Are there any hidden charges for early repayment?

50Fin does not charge prepayment penalties, allowing borrowers to repay early without extra cost or any hidden charges.

4. What happens if I fail to repay the loan?

The lender has the right to liquidate the pledged mutual fund units to recover the outstanding dues.

5. Which types of mutual funds can be pledged?

Most lenders accept equity, debt, and hybrid mutual funds. However, some ELSS funds may not be eligible due to the lock-in period.

6. How fast can I get the loan?

Digital lenders like 50Fin process loan approvals within 4 hours and disburse funds within 24 hours.

Conclusion

A loan against mutual funds is an excellent option for individuals who need liquidity but do not want to liquidate their investments. With lower interest rates, flexible repayment options, and quick processing, it provides a smart alternative to traditional personal loans.

For a seamless digital borrowing experience with competitive rates,

we at 50Fin offers a fully online process with fast approvals and zero prepayment penalties. If you have idle mutual fund investments, leveraging them for a loan can be a strategic financial move.

However, borrowers should always analyze their repayment capacity before pledging their mutual funds to ensure financial stability while availing of this facility.

With 50Fin, you can get your loan approved within 7 minutes.

Our tailored solution can help you get a loan against your mutual funds with only a 10.45% interest rate per annum.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know